CBDC's vs Cryptocurrencies

Central Bank Digital Currencies (CBDCs) and Cryptocurrencies as Bitcoin, have their own set of limitations and advantages.

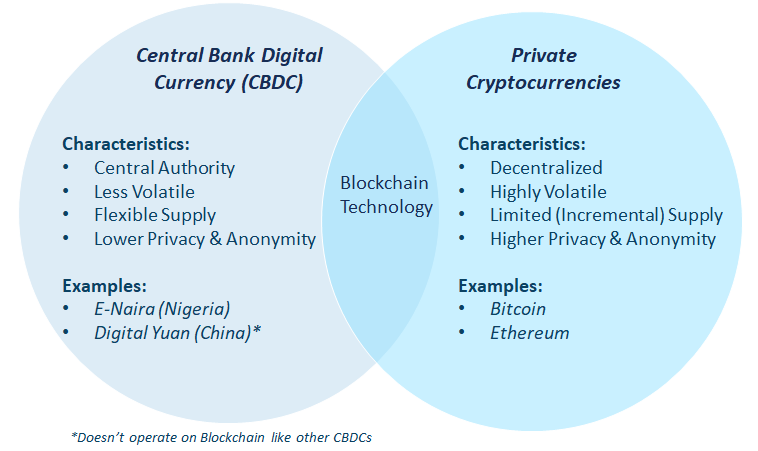

One of the main limitations of CBDCs is their lack of decentralization. Central banks control the issuance and distribution of CBDCs, which means that they can be subject to government control and censorship. Additionally, CBDCs can be subject to inflation and monetary policy decisions, which can lead to fluctuations in value.

On the other hand, independent cryptocurrencies, such as Bitcoin, are decentralized and not controlled by any single entity. This allows for more freedom in terms of transactions and ownership, and can provide a hedge against inflation. However, independent cryptocurrencies can also be subject to high volatility and are not yet widely accepted as a form of payment.

Another limitation of CBDCs is the issue of privacy. In order to combat money laundering and other financial crimes, governments may require banks and other financial institutions to collect and share transaction data. This can pose a privacy risk for individuals. On the other hand, independent cryptocurrencies offer a higher level of privacy as transactions are recorded on a public ledger but are pseudonymous, meaning that the identity of the user is not directly linked to the transaction.

Finally, it's worth noting that independent cryptocurrencies are relatively new and the technology is still being developed. This can lead to issues such as scalability, which can limit the number of transactions that can be processed per second. CBDCs, on the other hand, have the backing of central banks and governments, which may make them more stable and reliable in the long run.

In conclusion, CBDCs and independent cryptocurrencies each have their own set of s may offer stability and government backing, they lack decentralization and can pose privacy risks. Independent cryptocurrencies offer decentralization and privacy, but are subject to volatility and have limitations in terms of scalability. It's important for individuals to weigh the pros and cons and consider their own needs and preferences when deciding which type of digital currency to use